2020 seems to be the year of plant-based eruptions.

In January, more than 300,000 people supported the UK's "Vegetarian 2020" campaign. Many fast food restaurants and supermarkets in the UK have expanded their offerings into a popular plant-based movement. Innova Market Insights also listed "plant-based revolution" as the second trend in 2020; At the same time, Nelson's report shows that on top of last year's sales of plant-based foods of more than US$3.3billion, which is expected to exceed US$5billion by 2020.

The plant base is mainly supported by various plant proteins. What is the situation of vegetable protein market across the world? What are the driving forces behind plant protein development? What are the future application trends of plant protein in 2020? Please follow me to find out.

1. Global market for plant protein

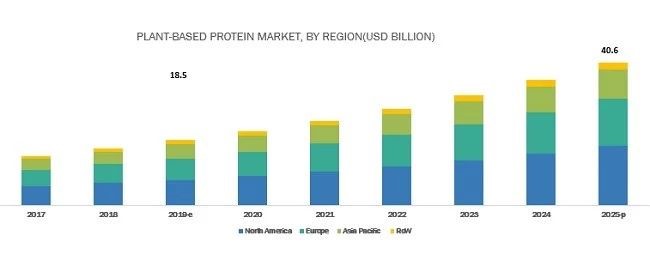

According to Markets and Markets, the global plant protein Markets is expected to be worth US$18.5 billion in 2019, It is expected to grow at a CAgr of 14.0% starting in 2019 and reach US$40.6 billion by 2025. Plant-based protein products are derived from plants such as soybeans, wheat and peas. Plant protein applications include protein drinks, dairy substitutes, meat substitutes, protein bars, nutritional supplements, processed meat, poultry and seafood, baking, food and sports nutrition products. Plant protein applications can enhance the nutritional and functional properties of the product, such as texture, emulsifying properties, solubility, stability and adhesion etc.

Source: Markets and Markets

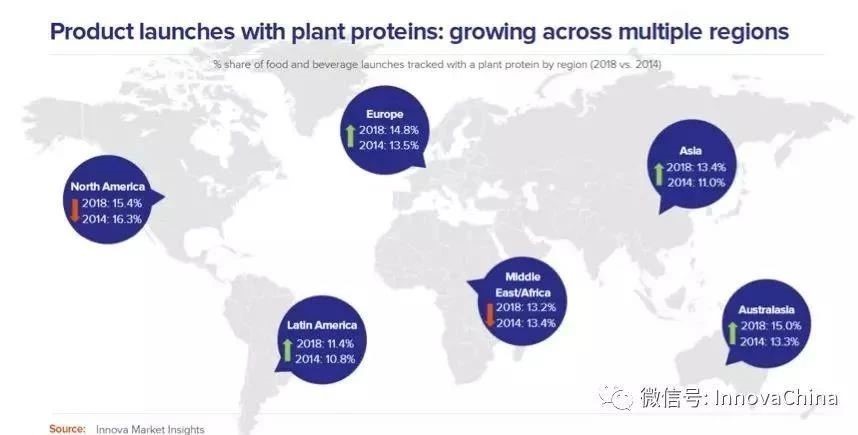

The application of plant protein in new food and beverage products has also been increasing in the world. According to Innova's Global New Product Database, which tracks plant protein claims of new food and beverage products worldwide, between 2014 and 2018, the proportion of them continued growing, with the exception of North America, the Middle East and Africa. Despite the decline in North America, the share of new product releases in North America remains one of the world's leading, accounting for 15.4% of total new product releases in 2018. Plant protein claims in Asia were the most significant increase, accounting for 13.4% of all new releases in 2018, an increase of 2.4% from 2014.

Source: Innova Market Insights

2. Market Driving Force of Plant Protein

1) Increased number of new releases

In food and beverage industry, more and more new products will use plant protein as the main highlight of the product. According to innova Market Insights, new food and beverage releases with plant protein claims were tracked globally at a CAgr of + 9 % between 2014 and 2018.

2) Change of consumer eating habits, advocating "clean" diet

Consumers pay more attention to food sources, and plants are what they consider "clean" sources. The trend toward a "clean diet" is largely driven by millennials who prefer healthy, ethical, natural, less processed foods.

On the other hand, consumers'eating habits are gradually changing, they are reducing meats and more prone to vegetation protein. In the uk, the "vegetarian 2020" campaign was supported by over 300,000 people and many fast-food restaurants and supermarkets in the UK have expanded their offerings to take part in a popular plant-based movement.

3) Large enterprises invest in vegetable protein market

● ADM

● Cargill

● CHS

● DuPont

● Yuwang Group

● Gushen Group

● Xinrui Group

● Shandong Kawah Oils

● Wonderful Industrial Group

● Scents Holdings

● Goldensea Industry

● Sinoglory

● FUJIOIL

● IMCOPA

● Shandong Sanwei

● Hongzui Group

● MECAGROUP

● Sonic Biochem

● Ruiqianjia

Xinrui Group – Shandong Kawah Oils invetsted USD 45,000,000 in 2016 to establish 4 soy protein isolate production lines with the output of 6000 tons annually based on the 12- year-old soybean oil extracting factory.

China had the largest capacity to process as much as 79 percent of global soy protein isolate, the total capacity is 500000 t/y and the actual producing amount in total is 350000t in 2019.

ADM (US) and DuPont (US) are the two giants in the global market. These companies have made expansion and investment the main strategy for expanding their market in plant protein. In January 2019, ADM expanded its presence in Brazil with the construction of a new soy protein production base in Campo Grande, South Mato Grosso State, Brazil, valued at USD 250,000,000. The company will produce a range of functional protein concentrates and isolates for ADM's current product line.

3. Application Trend of Plant Protein

1) Soy protein is expected to dominate the market in the next 5 years, with the emerging of pea and oat protein as the new trend.

Soy protein is widely used in the food and beverage industry due to the demand for high protein diet and the increasing popularity of soy protein. In a survey of plant protein sources by Aritzon in 1919, soy protein topped the list at US $3.12 billion. According to Innova data, soy protein was the leading ingredient in food and beverage new products announced by plant protein between 2014 and 2018, with 9% of related new products adopted. Soy protein helps lower cholesterol levels, improves metabolism, bone density, and can also reduce the risk of cancer. Soy protein isolate can be used in nutrition bars, meat substitutes, baking products, sports nutrition products and beverages, etc.

Apart from soy, pea protein consumption has increased rapidly in recent years. Global pea protein consumption has doubled from 2015, according to data from food company technical adviser enk Hoogenkamp, to 275000 tons, by 2020. Its consumption will grow 30% to 580000 tons by 2025.

Oat protein is also a kind of great potential plant protein. Oat contents 19% of protein, oat protein is rich in amino acids and essential amino acids, is a high-quality nutritional protein. Oat milk is a newly developed non-dairy vegetable milk. There are many functional similarities between oat milk and milk. Both are creamy and have a smooth texture and consistency. According to Mintel data, the European market in April 2017 to March 2018 listed new products, oat-based drinks and yogurt accounted for 14.8 percent, compared with 9.8 percent a year earlier.

2) Protein ssolate expected to dominate plant protein market in the next 5 years

Protein Isolate contains high Protein content and digestibility. Protein isolates are widely used in protein- and nutrition-related applications such as sports nutrition, protein drinks, and nutritional supplements. In recent years, because of its different functional characteristics, it has been widly used in a variety of beverages and dairy products to cater for athletes, body builders, vegetarians.

3) Sports nutrition, snacks are the application trend

Sports nutrition products and snacks are the trend for future applications. According to Innova Market Insights, the Global New Product Database tracks the launch of a new food and beverage product with plant protein claims, The growth of sports nutrition category is the most obvious, with an average annual compound growth rate of 32% from 2014 to 2018, followed by snack, with an average annual cgr of 14%.

Protein nutrition bar originally belongs to sports nutrition, with the upgrading of consumer awareness, it gradually moved closer to the category of snacks. Today, protein bars are not just for athletes, but also for the average consumer looking for a nutrient bar for breakfast or a daily snack.

The Application of Plant Protein in Protein Nutrition Bar in Recent Years:

● BEKIND Nuts bar

Source: Taobao

● PhD Nutrition Bar

64g (per piece) contains 23g vege protein.

Source: Innova Market Insights

● Probar Energy Bar

Each Probar contains 1 billion 10 active probiotics and 10g of vege protein.

Source: Google

● PDang Nutrition Bar

Each bar has 9-10g of vegetable protein, gluten free.

Source: Paleo Foundation

● Blake's Protein Bar

Source: Kickstarter

3. Summary

2020 seems to be the year of plant-based eruptions and the Nutrition Bar is the most popular in snack. Mars launched the BEKIND nut bar, aiming at post-exercise energy supplement and meal replacement scene in Dec., 2019, also trends to Chinese New Year snack gift pack. Can plant protein follow the trend and stack up in nutrition bars? We'll see.

References:

1. Plant-based Protein Market by Type (Isolates, Concentrates, Protein Flour), Application (Protein Beverages, Dairy Alternatives, Meat Alternatives, Protein Bars, Processed Meat, Poultry & Seafood, Bakery Product), Source, and Region - Global Forecast to 2025,Markets and Markets

2. Creation of Plant Protein, Innova Market Insights

Post time: Jan-11-2020